Need to manage your monthly subscriptions? A subscription tracker can help

Saving a few bucks is just an app or two away

Products are chosen independently by our editors. Purchases made through our links may earn us a commission.

Leave anything unattended long enough, and it'll surely get out of hand. As more apps and services have turned away from one-time purchases to subscriptions, your list of monthly expenses has probably grown over the years. Between streaming platforms like Disney+ and Peacock, and meal kit delivery services like Freshly and Marley Spoon, things can add up quickly.

While a simple spreadsheet or text-based list might do the trick, there are easier ways to keep track of your various recurring expenses, either to make sure you're not blindsided by renewals or to keep track of specifics like which cards you used and when you're charged. No need to spend hours combing through the App or Play Store to find the right tracking app for you, as we've rounded up the best options available to keep your subscriptions in order.

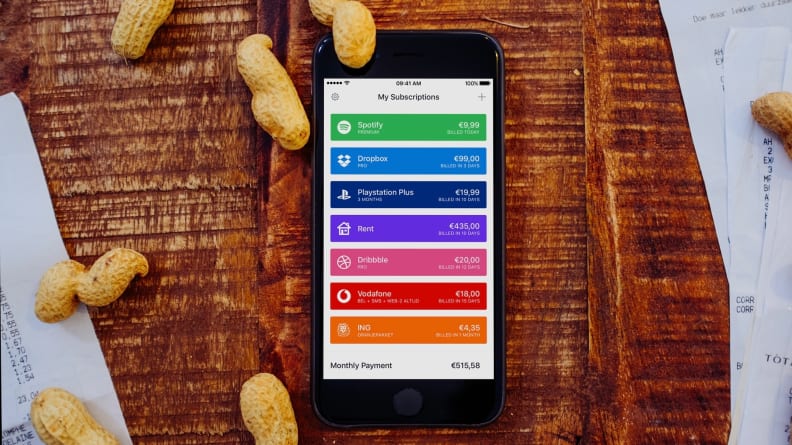

The best subscription tracker for iOS: Bobby

Bobby's simple interface lets you plug different subscriptions (with attributed icons) into a list of all your monthly and annual fees.

If you like to have as little friction in your tracking as possible, you should try Bobby, a free app available on iOS. While many apps offer budgeting options for recurring charges, Bobby adds the ability to plug in specific, pre-built subscriptions from popular services and companies.

There are options for Spotify, Netflix, Adobe, and even subscriptions for gyms such as 24-Hour Fitness, and each pre-built subscription has an accompanying icon for easier distinction. Below your subscription list, Bobby will tell you how much you're spending per month on subscriptions altogether.

For each subscription, you can add your own description, the date of your first bill, and billing frequency. You can even add an end date if you only need a subscription for a certain period of time. That won't deactivate the subscription itself, but you can set a reminder within the app so you can cancel on time.

To add more than five subscriptions, you'll have to pay a one-time fee of $1 for unlimited subs. There are also options to upgrade the app's organization with categories, as well as an upgrade for secure iCloud sync if you plan on tracking across multiple devices. Unlocking everything only requires a one-time $3 fee, and you can always test the free tier for a while to see if Bobby's approach to management works for you before making any commitments.

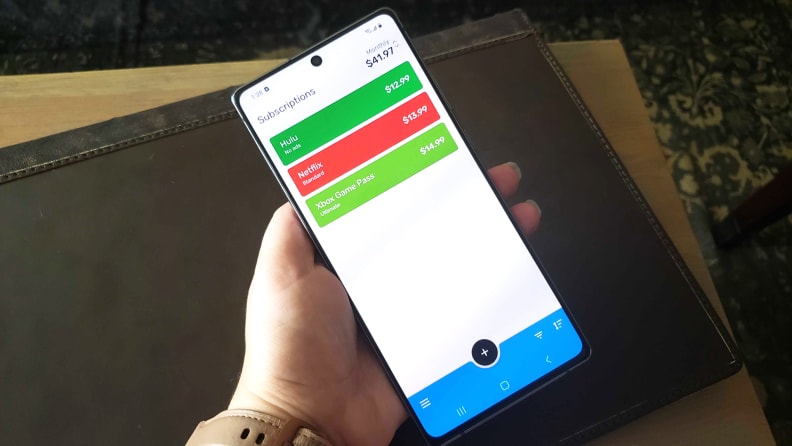

The best subscription tracker for Android: Subscriptions

The Subscriptions app makes it easy to add and color-code what comes out of your budget every month.

Unfortunately, Bobby is an iOS-exclusive, but there's a similar option available for Android users. Subscriptions, available for free in the Google Play Store, has many of the same features as Bobby.

You can add subscriptions by price, frequency, and even payment methods that will then populate into a list with your monthly total up at the top. There are also options to label each subscription with categories such as entertainment, work, or gaming, so you can get a clear idea of where all your money's going.

The only downside is that, unlike Bobby, there aren't any pre-built subscription options like Hulu or 1Password, so you'll have to input everything manually. You can still color-code everything, though (red for Netflix, green for Spotify, etc.), so it's a little easier to parse than a plain-text list.

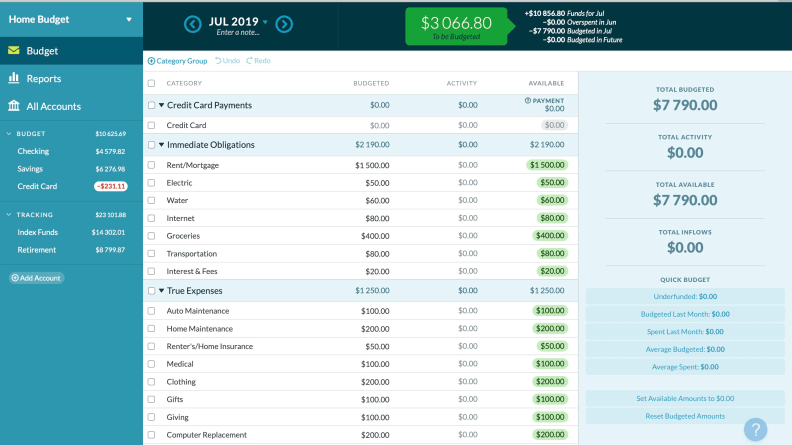

Full-featured budgeting: YNAB

You can easily create a "Software Subscriptions" group for your expenses in YNAB, and once you label a specific transaction once, any future ones will automatically get lumped into the same category.

As great as Bobby and Subscriptions are, they're mostly there to keep your subscriptions tab from running over. If you need a full-fledged budgeting app, you should try YNAB (You Need a Budget). It's available on nearly every platform, and its budgeting courses can help you develop new ways to keep your money in order.

Within the app, you can link all your various bank accounts and credit cards, with categories to organize your transactions like specific utilities, medical expenses, and gifts. You can also create categories for things you're saving to buy, such as a new phone or gifts for the holidays.

For each card you link to your YNAB account, you'll be able to see those transactions inside the app. You can even give charges custom names, and add labels for things like recurring subscriptions so you can gather everything in a single location.

At $84 per year, it's certainly not cheap, but the money you'll save if you stick with YNAB might offset that cost.

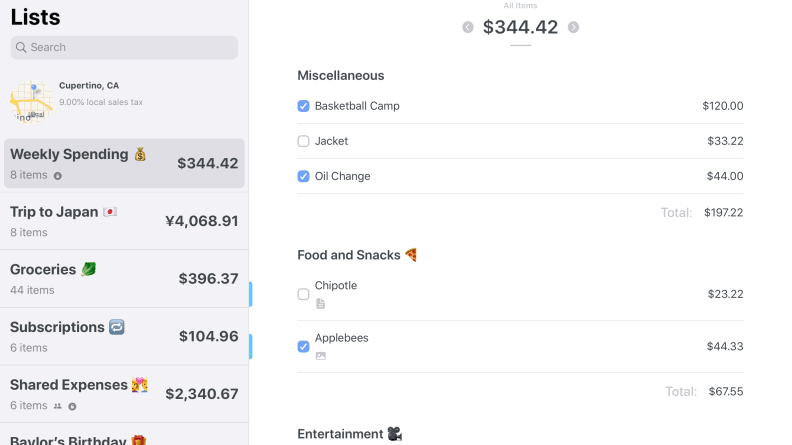

Honorable mention: Spend Stack

Spend Stack allows you to create lists for budget planning, recurring expenses, and any other sort of fees that might pop up.

If you'd like an iOS-friendly budgeting app that goes beyond subscriptions but doesn't cost as much as YNAB, Spend Stack is worth a look.

It doesn't automatically sync transactions like YNAB, but you can create lists with recurring expenses, so you can build the same functionality as something like Bobby or Subscriptions while having more robust budgeting capabilities as well. If you build a list specifically for your subscriptions, you can look at the app's tracking to see how much your subscriptions have cost you over the past week, month, and year.

You can create lists for past transactions as well as future purchases. So, your big list of things you need to buy for your new kitchen can live alongside your monthly spending limit so you can see what you could check off the list each month. You can also tag each item or purchase with things like "Utility" or "Gift" so you can track where your money's going over time.

If you use an Apple Card, you can even sync your purchases directly to the app, although this functionality doesn't extend to other credit cards.