8 budget apps to help you keep track of your money

See where your money is going—and plan smarter for the future.

Products are chosen independently by our editors. Purchases made through our links may earn us a commission.

The concept of budgeting may seem simple: Don’t spend more than you make. But putting this into practice is where it gets tricky. Budgeting apps are a great way to keep all of your accounts, bills, and payment methods in order (and in one place!). Nowadays, budgeting is more important than ever with economic uncertainty during the coronavirus pandemic.

But before you hand over your most intimate financial details to a budget app, you need to regard one very important detail carefully: your privacy. “As a consumer, you want [app makers] to tell you everything,” says Don Scherer, a cybersecurity expert and professor at the Tulane University School of Professional Advancement. “Users want apps to be very transparent, tell us what they’re doing with our information, and who they sell it to.”

While privacy policies are often dense and full of legalese, Scherer says there are a few things you can look out for to understand how your data is being used. First, are they clear on who they are sharing data with? Business partners or service providers like Amazon Web Services are essential to running such an app, but companies may also share your data with other third-party vendors, advertisers, or researchers. Additionally, if a service is free (or even if it’s not), understand what that means for your data—in particular, is it being sold? Thirdly, apps may offer services or promotions or serve up advertisements, targeted based on your app use and spending habits. Privacy policies are also subject to change, so you should review any updates when notified. (Our notes below were accurate at the time of publication.)

The budget apps we surveyed run the gamut from basic free expense trackers to robust personal finance coaches. Read on to decide which best fits your financial goals, and data-sharing comfort level.

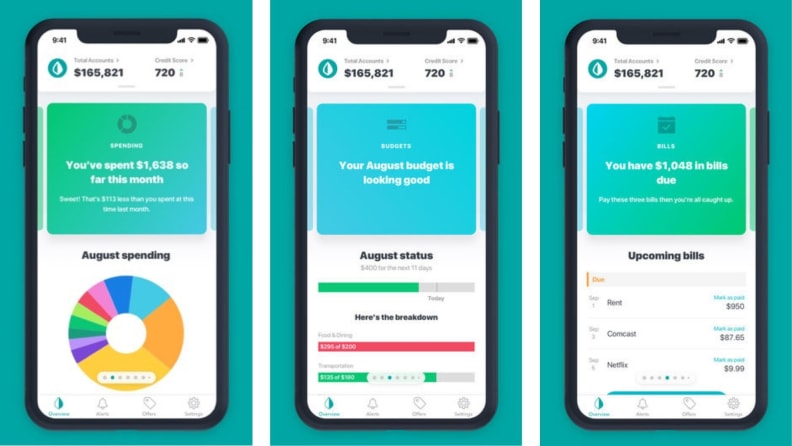

Mint: all your accounts in one place

Cost: free

Who owns it: Intuit, maker of TurboTax and Quickbooks

How it works: Mint’s real claim to fame is its ability to automate tracking your spending. The service says it works with “almost every US financial institution connected to the Internet.” Once you add your accounts, you will see your balances, bills, credit score, and more, all at a glance.

Mint also breaks down your spending by category in real time, so you can track where your money is going. You can also use that view to see how cutting back in various categories can help you save. A daily budget shows you not only how your spending decisions add up, but also how your current spending affects the money you will have at the end of the month and year.

Mint also analyzes offers for everything from checking accounts to CDs and IRAs to suggest which savings plan will give you the greatest return based on your savings potential, goals, and lifestyle.

What Mint collects: Mint collects personal information including your name, shipping/billing address, email, phone, username, and password. It also gets information from third parties (like your credit card company) when you sync that account and collects information about how you use the app.

How your data is used: Mint uses your information to advertise Intuit services and other third-party products and services, as well as to personalize your app experience. Last but certainly not least, Intuit may use some of your data in its research, minus any personal identifying information.

Get Mint for iPhone on iTunes Get Mint for Android on Google Play

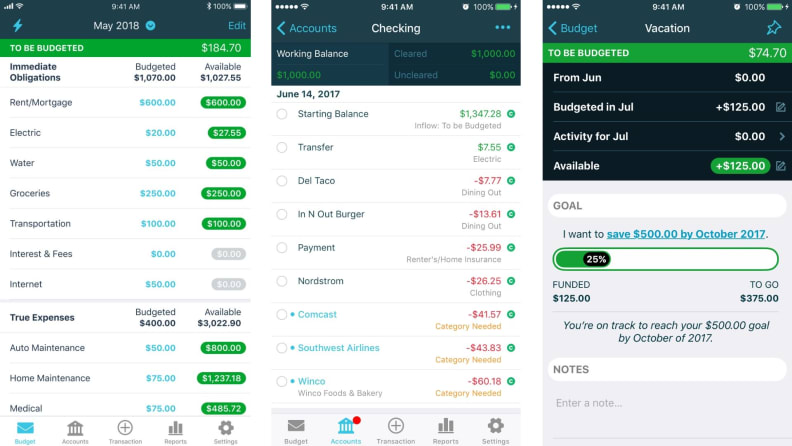

YNAB: geared toward beginners

Cost: $84/year

Who owns it: YNAB is independently owned.

How it works: YNAB, formerly "You Need a Budget," aims to help newbie savers and is based on four budgeting rules the founder established for himself: 1. prioritize your spending, 2. break down big expenses into monthly “bills,” 3. adjust your budget as you spend, and 4. get a month ahead by purposefully spending less than you earn. The application itself is fairly simple, but that’s the point: to give users a framework to get a better picture of monthly expenditures and get those under control.

You don’t need to link your accounts to YNAB (though you can)—just enter your current balance to get started. That figure will become your “to be budgeted” amount, which you can allot to all of your regular monthly expenses as well as larger expenses that come along less frequently (which are divided into monthly goals based on due date).

To keep track of spending, you may manually enter dollar amounts as you spend them, link your bank account to auto-import your purchases, or download your expenses from your bank and upload them to YNAB to keep track of spending against goals.

What YNAB collects: YNAB collects the personal information you provide, as well as information from your financial accounts, and location information from your transaction records using the app. This can include your username (or social username if you use that to log in), your IP address, your account login information, and information tracked via cookies when you visit YouNeedaBudget.com.

How your data is used: YNAB doesn’t sell your information to third parties.

Get YNAB for iPhone on iTunes Get YNAB for Android on Google Play

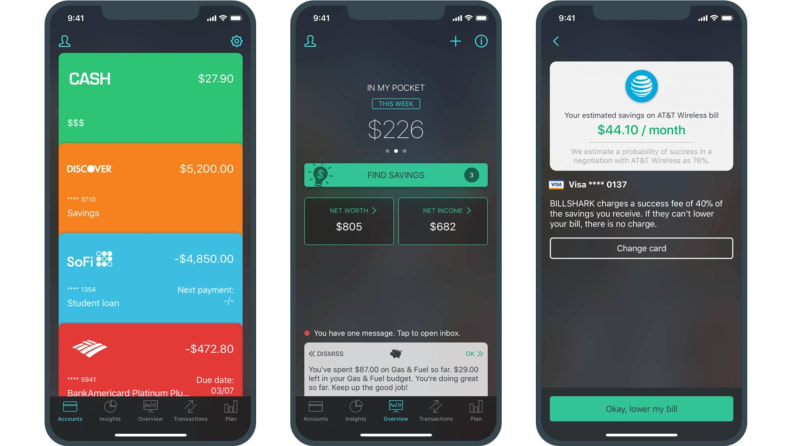

PocketGuard: automatic budgeting

Cost: free for PocketGuard Basic; $3.99/month or $34.99 annually for PocketGuard Plus

Who owns it: PocketGuard is independently owned.

How it works: PocketGuard is designed for those who are too time-strapped—or stumped—to build a budget on their own. PocketGuard automatically outlines a budget for you from your account data based on your income, bills, and financial goals, and suggests ways to find savings, including negotiating lower bills, signing up for high interest savings accounts, and more. It also sets spending limits for users by category.

The app begins with a familiar setup: Link all your accounts to view your finances in one place and track your spending by category using dynamic pie charts. Though expenses are categorized automatically, you can also group them using hashtags to see, for instance, the total of meals, transportation, and hotel costs for a trip. The basic plan assigns expenses to standard categories, but you can create custom categories with Plus. The premium plan also allows users to manually input cash spending and track cash bills.

Last but not least, the app also constantly updates the amount “in my pocket,” or the money you have left over after you’ve paid the bills and set aside some money for savings that you can use for everyday spending. You can view it to see the amount you have to spend per day, week, and month. Plus gives you the ability to create your own categories, track cash you send and receive, and set multiple financial goals.

What PocketGuard collects: PocketGuard collects personal information when you register including your name, email address, date of birth, and zip code. Users can also provide additional optional information including your personal profile and other contact information. The app also tracks how you use the service, your transactions, IP address, mobile device ID, browser type, location, and Internet provider.

How your data is used: PocketGuard doesn’t sell your personal information to any third parties and offers an opt out for having your personal information used in some cases. The service uses cookies to improve your experience with the app, but not to serve up advertising.

Get PocketGuard for iPhone on iTunes Get PocketGuard for Android on Google Play

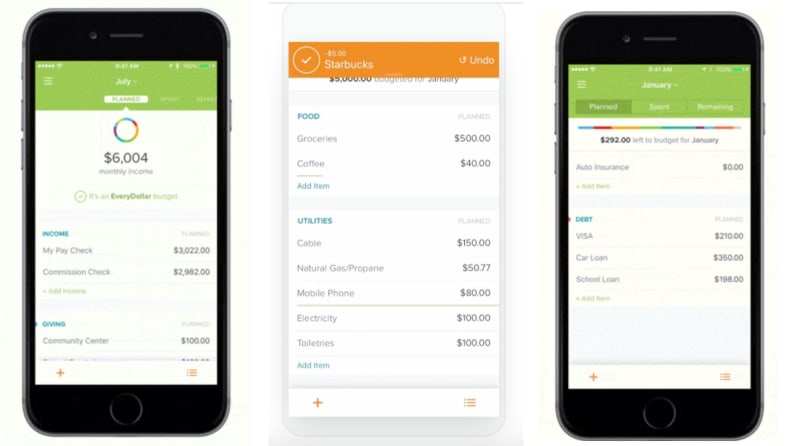

EveryDollar: digital financial advice

Cost: free for EveryDollar; $129.99 annually for EveryDollar Plus

Who owns it: Ramsey Solutions, run by author and radio host, Dave Ramsey

How it works: EveryDollar holds your hand every step of the way when it comes to budgeting. The app includes professional financial advice: Free users are served up service and generic savings advice, while Plus users get access to “Financial Peace University,” educational materials and a series of classes from financial guru Dave Ramsey.

Aside from expert advice, EveryDollar promises to get you up and running with a monthly budget in just 10 minutes. You start by plugging in your monthly income and planning out your recurring expenses. You can then set daily or monthly budgets, manually enter your spending throughout the month, and split your expenses across categories. You can either create new budgets every month or copy your budget from the previous month. The ability to connect bank accounts (which reduces the manual data input) come with the Plus subscription.

What EveryDollar collects: EveryDollar’s privacy policy does not spell out the personal information the service collects, though it does state that the site asks for broad demographic information. However, the EveryDollar site and app collect technical information including your browser type, IP address, and behavior on its site. The site also uses cookies to store your preferences.

How your data is used: EveryDollar doesn’t sell user data, but it does provide anonymized data to advertisers, as well as to fellow users to see how spending habits compare to similar users.

Get EveryDollar for iPhone on iTunes Get EveryDollar for Android on Google Play

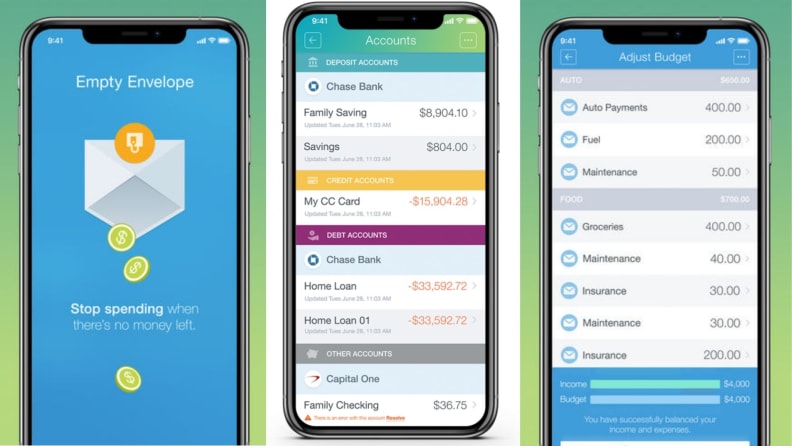

Mvelopes: online bucket budgeting

Cost: $4/month for Basic; $19/month for Plus, $59/month for Complete

Who owns it: Finicity, a financial technology company that specializes in data aggregation

How it works: Mvelopes is based on the concept of envelope budgeting, but instead of setting aside the cash you’ll use to pay each bill in a physical envelope, Mvelopes does that digitally by setting spending limits by category so you can’t dip into, say, your rent money for online shopping. As with traditional envelope budgeting, you can see how much money is in each “envelope” and once one envelope is empty, you can’t spend in that category again until your next paycheck.

As a nice bonus, Mvelopes tracks your credit card spending and automatically transfers any purchases made in a category to the “credit card” envelope when you use your card, to help you plan towards paying off your credit card bill.

Mvelopes is more about tracking your spending and knowing you have the money available before you make a purchase. Even Basic memberships sync with your financial accounts and offer automatic transaction syncing. The Plus membership includes long-term planning and debt tools and quarterly check-ins with a financial coach, while the Complete plan includes a personal financial coach who will hold monthly calls and help users create a custom financial roadmap.

What Mvelopes collects: Mvelopes collects personal information including your name, address, phone number, email address, usernames, passwords, PINs, date of birth, social security number, and additional optional information you can choose to disclose.

How your data is used: The site tracks anonymized data about how you use the service. Your data is used to suggest products, services, and offers though it is unclear from the privacy statement whether these come from Finicity, a third party, or both. Users can opt out of receiving promotional information. Information is also shared with partners that you sign up for through Mvelopes.

Get Mvelopes for iPhone on iTunes Get Mvelopes for Android on Google Play

Goodbudget: for managing a household

Cost: free for Goodbudget; $6/month or $50 annually for Goodbudget Plus

Who owns it: Dayspring Technologies, a web design company based in San Francisco

How it works: Goodbudget is built for sharing, making it especially targeted toward households of two or more adults. The basic plan allows two devices per account and the Plus plan includes up to five devices, meaning that couples and families can share income and expenses to keep track of budgeting.

Goodbudget is also based on the envelope system, assigning the income you input at the beginning of the month to a variety of categories you set, the idea being that users can plan their spending rather than simply tracking it. The free version supports up to a year of spending history in 20 envelopes, while Plus subscribers can track up to seven years of expenses across unlimited envelopes. Goodbudget’s tracking is based on manual input; the app doesn’t connect with financial accounts.

What Goodbudget collects: Goodbudget collects personal information including your name, email address, and any data you provide while using the app.

How your data is used: Goodbudget tracks anonymized data about how you use the service, but it doesn’t sell user data.

Get Goodbudget for iPhone on iTunes Get GoodBudget for Android on Google Play

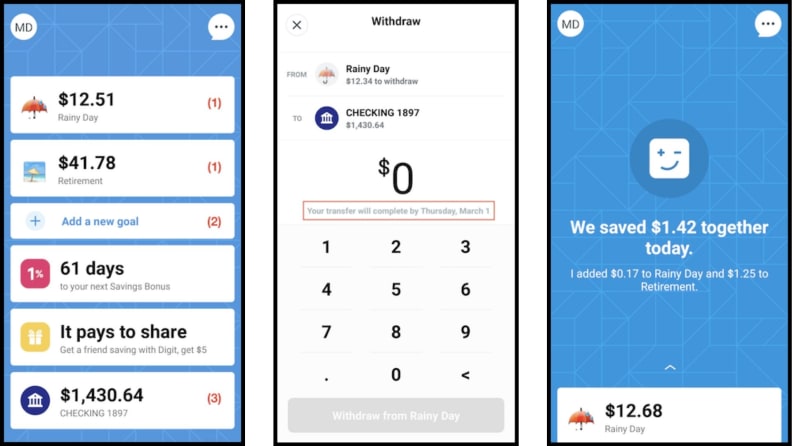

Digit: savings-focused budgeting

Cost: $2.99/month

Who owns it: Digit is independently owned.

How it works: Digit focuses on finding savings in your monthly budget. Once you connect your bank accounts, the app analyzes your spending and automatically withdraws the “perfect amount” every day into a savings account set up through the service. You set one or more goals—anything from picking up a birthday gift for a friend to paying down student loans—and the app’s algorithm tracks how you spend to determine a safe amount to save.

Savings are intended to be small amounts that you won’t miss in your budget—$2 here, $8 there—that will add up over time. Digit’s accounts are FDIC insured (just like your regular bank account), offer a 1% savings bonus after the first three months, and include overdraft reimbursement for up to two transactions, should the algorithm cause an error.

What Digit collects: Digit collects personal information including your name, email address, phone number, banking information, age, gender, location, address, date of birth, social security number, citizenship information, occupation status, and income source, as well as information about your transactions and information about your phone or other devices you use to access Digit.

How your data Is used: Digit tracks your activities via cookies, needed to personalize the service and save your preferences, but also for the purposes of social media integration and advertising. Digit will also use your personal information to serve up third-party products and services and display content based on your interests.

Get Digit for iPhone on iTunes Get Digit for Android on Google Play

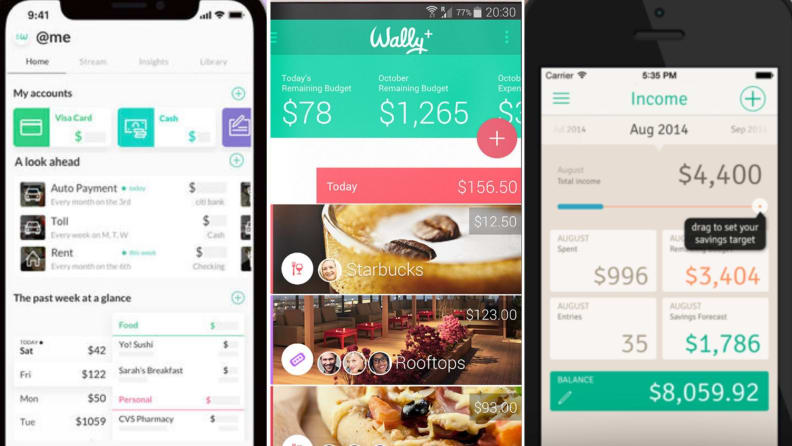

Wally: manual budgeting for international users

Cost: free

Who owns it: Wally is independently owned.

How it works: Unlike other budgeting services that have websites, Wally is only available via its smartphone app for iOS and Android devices. Wally is also unique in being geared towards an international audience and accepting a wide range of currencies. (“All of them” according to the app’s site.)

The app doesn’t link up with your accounts, so you’ll need to manually enter your income and purchases to keep track. Each month you start with your allotted budget, which is translated into a daily budget, and purchases go against that. You can view your expenditures as daily totals over the course of the week, or drill into specific categories.

An income view lets you set a monthly savings target; the app offers a “savings forecast” based on your spending to help you pick one that’s reasonable, or figure out where you can cut back to make a more ambitious goal. If you don’t want to manually enter purchases, Wally lets you take pictures of receipts to keep track of expenditures and it will also log your location to automatically identify where you’re making purchases.

Additionally, Wally offers up insights about how your spending compares to others in your age group, city, and income bracket.

What Wally collects: The app collects personal information including your name, email address, password, date of birth, and gender.

How your data is used: Wally’s privacy policy is not directly linked from its website, but you can find it, along with the app’s terms of service, using a search engine. That said, Wally’s privacy policy spells out that data collected from the app isn’t sold to third parties. The app provides data to users about how their spending habits compare to other similar users and also provides insight to research partners, but the data the app collects is anonymized.

Get Wally for iPhone on iTunes Get Wally for Android on Google Play