Pros

-

Intuitive for tax novices

-

Options, options, options

-

Comprehensive customer guarantees

Cons

-

Exited the IRS Free File program

-

Free version doesn't include unemployment income

What is TurboTax?

Filers can access TurboTax software three ways: online, through a CD, or as a digital download. There are four product tiers to choose from, depending on your tax needs. Note that the prices listed here are the standard retail prices; you may find promotional discounts or coupon codes to save money on your purchase.

Free Edition: This product doesn’t cost anything to file simple federal or state taxes. It includes W-2 income, the Child Tax Credit, the Earned Income Tax Credit, and the student loan interest deduction.

TurboTax Deluxe ($59 + $49 state filing fee): The Deluxe version could help you lower your tax bill by giving you access to more than 350 deductions and credits, including the mortgage interest deduction and child care tax credit. You'll need this tier if you received unemployment income.

TurboTax Premier ($89 + $49 state filing fee): This upgrade covers investments (including stocks, bonds, and cryptocurrency) as well as rental property income.

TurboTax Self-Employed ($119 + $49 state filing fee): Claim both personal and business income. It also includes specialized deductions for self-employed individuals.

What we like about TurboTax

With TurboTax, you can easily upload your tax information—even if you've previously used other services.

We tested online tax filing software programs for the 2021 tax year, including TurboTax. Cost is definitely a factor, but it’s not the only thing to consider when choosing the best tax software. It’s equally important to have access to all of the credits, deductions, and income reporting you need to maximize that tax refund (or minimize your final bill).

We walked fictional tax filers through TurboTax while evaluating multiple features. For instance, how easy is it to navigate the software? Is it easy to get answers to your tax questions? And how does the software guarantee its results? Here's what we liked most about the platform.

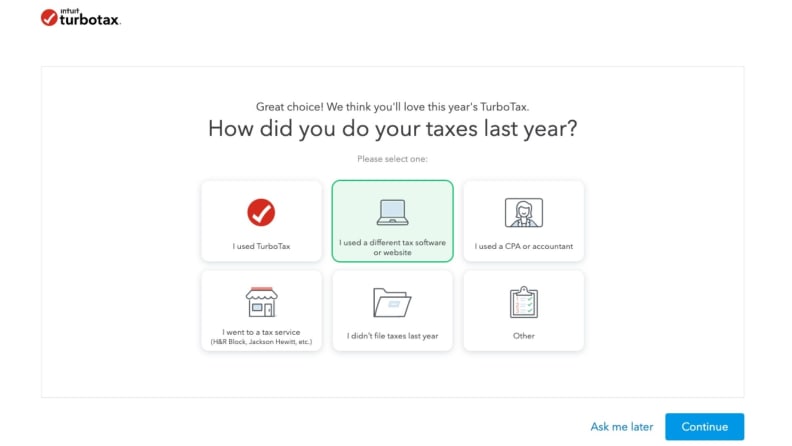

You can upload last year’s tax return

Getting started is easy regardless of where you filed your taxes last year. Existing TurboTax customers will automatically have last year’s tax return connected to this year’s software. New customers simply need to upload a PDF of their previous return.

TurboTax then imports the data and you simply update any information that needs to be changed, like a new address or a change in your dependents. Your information is broken into four categories: personal info, income, tax breaks, and a summary of the year.

It’s easy to import financial data

Not only can you upload your previous year’s tax return, you can also easily import new information required for this year’s filing. Instead of manually typing in each line of your W-2, snap a photo and TurboTax will extract the required information.

You can also connect directly to your financial institutions to import data for 1099 and 1098 forms (these report data like retirement account withdrawals, dividends, interest, and miscellaneous income).

Frequent stock traders also benefit from TurboTax, which allows you to import a large amount of stock and cryptocurrency transactions. Instead of being limited to 200 (which is common for tax software), TurboTax’s limits are 4,000 crypto transactions and 10,000 stock trades. Plus, you’ll find all of the most common trading brokerages and robo-advisors on its partner list, like E*Trade, Robinhood, Fidelity, Wealthfront, and Betterment.

It integrates with QuickBooks for self-employed

Self-employed individuals and small business owners will appreciate the integration between TurboTax Self-Employed and QuickBooks Self-Employed. Directly import your expenses so you don’t miss any deductions.

Plus, TurboTax also walks you through industry-specific deductions to make sure you capture every expense possible. It includes industries like ride-share driving, delivery services, real estate, consulting, online sales, and more.

There are multiple support options

TurboTax lets you choose the level of professional support based on your needs and budget. The software automatically includes a searchable database of questions and answers, and topics if you want to completely DIY your taxes. But you also have options to access professional advice with TurboTax Live.

As you work through your tax return, hit the “Live Help” button for instant access to a tax professional. They’ll also review your return before you submit. The cost depends on the tier, starting at $119 for TurboTax Deluxe (plus a state filing fee).

Finally, TurboTax offers a Full Service option, which gives you a specific tax expert or CPA dedicated to your account. They’ll file and sign on your behalf, giving you an extra layer of comfort that everything is filed correctly.

What we don't like about TurboTax

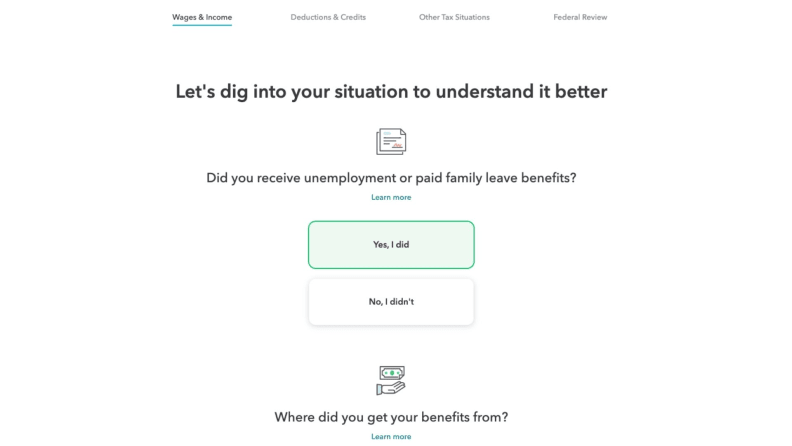

TurboTax's Free Edition no longer supports unemployment income.

Its free version is limited

One downside to TurboTax is that the Free Edition is limited in its offering. It only allows you to include the following on your return:

- W-2 income

- Some interest and dividend income (from 1099-INT and 1099-DIV)

- Standard deduction

- Student loan interest deduction

- Child care credit

- Earned income tax credit

This year, you cannot include unemployment benefits as part of the Free Edition; instead, you’ll need to upgrade to the next level. Additionally, you must file by February 15 in order to access free live help. While it’s helpful to get access to expert live help at no additional cost, you need to be on top of your game in order to file on time for this service.

It exited the IRS Free File program

As of July 2021, TurboTax no longer participates in the IRS Free File program. This gave free TurboTax access (via the IRS website) to tax filers earning under $72,000. TurboTax does still offer its Free Edition, but that’s one less free filing opportunity for those who qualify for the federal program.

Is TurboTax worth it?

We like that TurboTax is intuitive, plus it has plenty of options for different types of filers.

TurboTax comes with an ease of use regardless of what level of tax filing you need. But there are some scenarios where it really makes sense to choose TurboTax for your taxes this year.

People who want hands-off taxes: Tax filers who want to maximize the automation of the filing process will appreciate how much you’re able to import and upload into TurboTax. There’s still the option to manually enter data, but if you prefer to connect accounts and snap photos instead of typing everything in, you won’t find many other tax software options that automate as much as TurboTax.

Basic W-2 filers: If you don't have complicated tax needs, there’s no reason not to file using the TurboTax Free Edition. Just be sure you’re not missing out on any major deductions you’re eligible for that aren’t included.

Frequent stock/crypto traders: Stock trades that aren’t in a retirement account typically need to be reported on your tax return. People who trade frequently (like day traders and swing traders) may have a substantial number of trades to report. Not only does TurboTax Premier make it easy to import that information, you also get to include a lot more trades than some competitors.

Self-employed individuals: The comprehensive TurboTax Self-Employed edition claims to lower your tax bill as much as possible. Its prompts include industry-specific information to make sure you’re not leaving any money on the table via forgotten expenses and deductions. Plus, you can import your data from QuickBooks Self-Employed for an extremely streamlined process.

This review is an evaluation of the consumer experience using an online tax prep service. We’re here to share what we learned, but this is in no way a substitute for financial advice. Please consult a financial professional if you have questions about how to file your taxes.

Meet the tester

Lauren Ward

Contributor

Lauren is a personal finance writer covering topics like taxes, investing, and real estate. Her work has appeared on Bankrate, Money Under 30, This Old House, and more. She lives with her family in Virginia and loves gardening and playing board games.

Checking our work.

Our team is here to help you buy the best stuff and love what you own. Our writers, editors, and experts obsess over the products we cover to make sure you're confident and satisfied. Have a different opinion about something we recommend? Email us and we'll compare notes.

Shoot us an email