Pros

-

Sleek interface

-

Tax professionals can file on your behalf

-

Free version includes unemployment income

Cons

-

Difficult to skip around

-

Doesn't participate in the IRS Free File program

What is H&R Block?

There are multiple versions of H&R Block’s tax software available, depending on your financial background. The prices listed here are the base retail prices for each product tier. H&R Block may have sales promotions for lower prices, especially leading up to the federal tax filing deadline on April 18, 2022. Paid tiers require an additional fee per state filed.

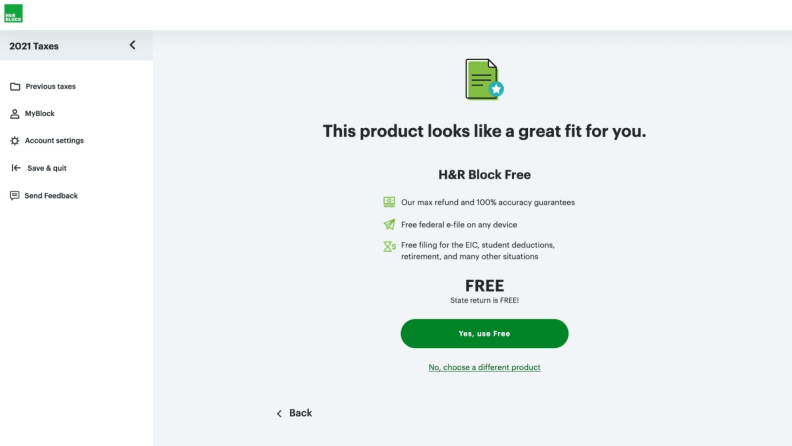

H&R Block Free Online: Both federal and state taxes are included in this version. You can file your taxes for free if you have W-2 and/or retirement income. It also includes the Earned Income Tax Credit, Child Tax Credit, student tuition, and student loan interest deductions. Unemployment income is covered, too.

H&R Block Deluxe + State ($49.99 + $36.99 state filing): Maximize your deductions by upgrading to Deluxe, which also covers self-employed income such as freelancing and gig work. This version comes with one state program included in the price, but there’s also an option to get the Deluxe program without including state filing.

H&R Block Premium ($69.99 + $36.99 state filing fee): Premium is ideal when you have income from investments beyond retirement account contributions. People with rental property income, investment trading, or cryptocurrency transactions also need to upgrade to this version with H&R Block.

H&R Block Self-Employed ($109.99 + $36.99 state filing fee): This version is designed for small business expenses. You can import 1099-MISC and 1099-K forms from clients and track your expenses. And if you’re an Uber driver, you can connect your driver’s account with H&R Block to import all of your data.

H&R Block Premium & Business ($89.95 + $ 39.95 state filing fee): While this isn’t technically an online tax software option, H&R Block also offers a downloadable Windows program for small business owners. You can’t log onto your online account from anywhere and jump in as you would with the other versions; instead, you’ll need to complete your taxes on a single device. In addition to the features at the Premium level, you can file your business taxes. For business owners with employees, it also handles payroll and all the forms you need to send out to your staff and contractors, like W-2s, 1099s, and 940s.

What we like about H&R Block

With H&R Block, you can easily upload information, even if you've used different tax software in the past.

We tested online tax filing software programs for the 2021 tax year, including H&R Block. Cost is definitely a factor, but it’s not the only thing to consider when choosing the best tax software. It’s equally important to have access to all of the credits, deductions, and income reporting you need to maximize that tax refund (or minimize your final bill).

We walked fictional tax filers through H&R Block while evaluating multiple features. For instance, how easy is it to navigate the software? Is it easy to get answers to your tax questions? And how does the software guarantee its results? Here's what we liked most about the platform.

Its free version is good for students, parents, retirees, and unemployment recipients

H&R Block Free Online is basic, but it covers a variety of life stages. Students can deduct some tuition payments and all student loan borrowers can access the student loan interest deduction.

Parents can also report their Child Tax Credit to make sure they received their full benefit (or return some of the funds if they received more than allowed). Another standout with H&R Block is that retirement income is included in the free edition. Anyone who is eligible for the Earned Income Tax Credit can also claim this benefit.

Finally, H&R Block Free Online covers unemployment income, too.

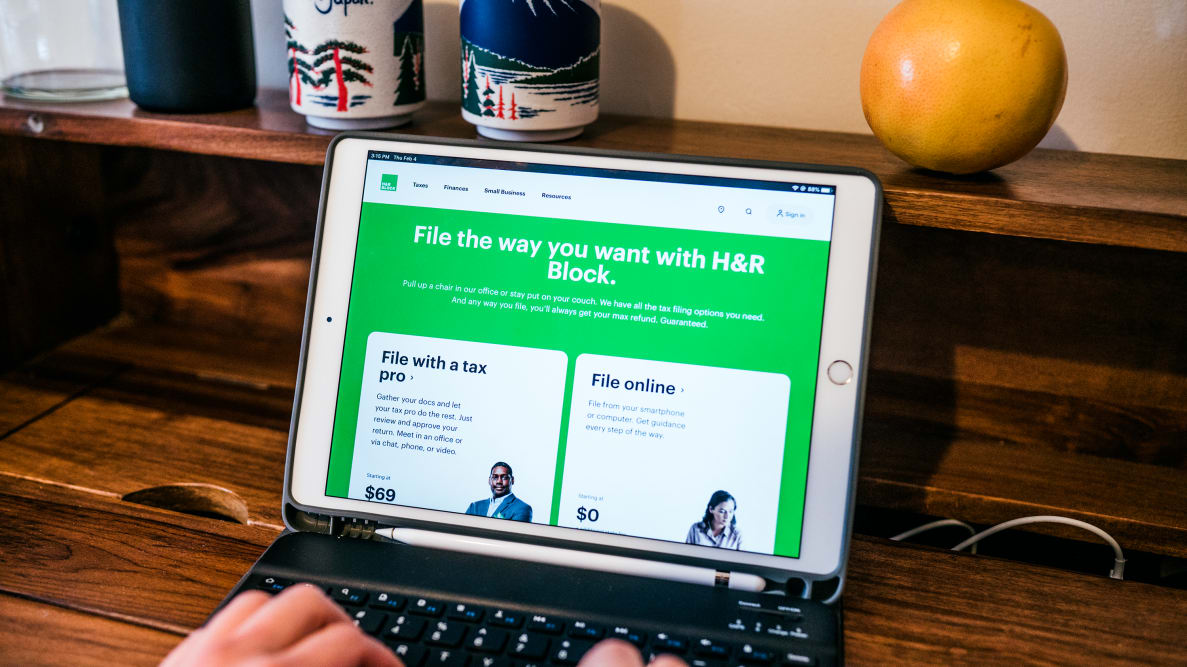

You can file online or through the app

H&R Block has both an online platform you can access through your computer, as well as a mobile app that you can download for your smartphone or tablet. Be careful to select the H&R Block Tax Prep app. It’s different from MyBlock, which is a separate H&R Block app that provides year-round financial management. You can find the Tax Prep on the App Store, Google Play, and Amazon.

The mobile app makes it easy to snap photos of your W-2s and other documents you’ll need to upload. And if you want to switch to your computer to fill in other details and review on a larger screen, your account will seamlessly sync between both platforms.

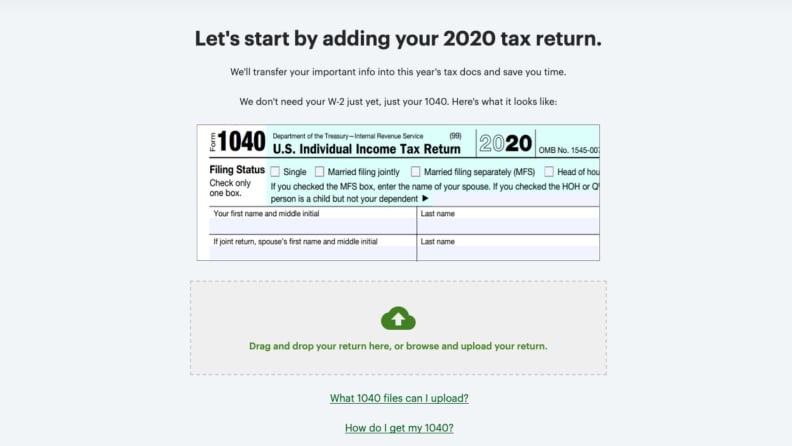

Importing previous tax data is easy

H&R Block provides two methods for importing data from last year to simplify this year’s filing process. First, you can upload a tax data file from either H&R Block or TurboTax. This is the most efficient option that gets the most detail to include in your new return.

The other option is to scan or snap a photo of a PDF of last year’s federal return. This can come from any source, including any other tax software or a CPA.

What we don't like about H&R Block

While H&R Block's unpaid tier covers simple tax situations, the company doesn't participate in the IRS Free File program.

It’s difficult to skip around

The online version of H&R Block has a user-friendly interface, but the downside is that it has a very linear feel when entering your tax information. Sections like income need to be completed before moving on to another area. It forces you to be organized, but can also make it hard to complete your taxes as you gather information.

It doesn't participate in the IRS Free File program

H&R Block has its own free edition, but it stopped participating in the IRS Free File Program in 2020. This program helps tax filers earning $73,000 or less to get access to quality tax filing software directly through the IRS website.

Is H&R Block worth it?

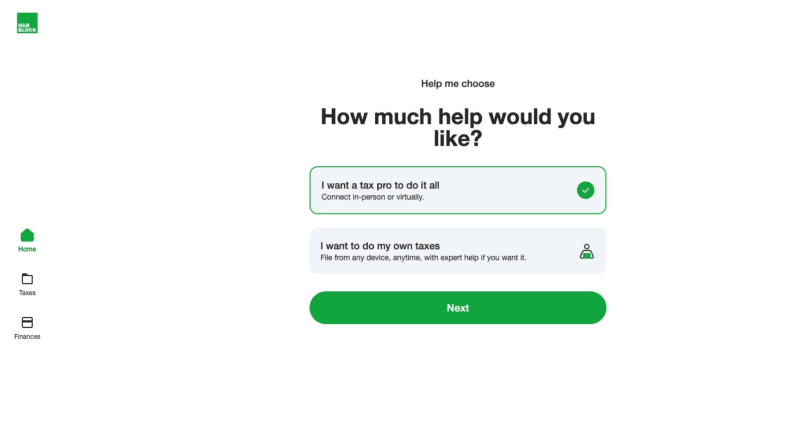

There's tax professionals at your fingertips with H&R Block.

H&R Block is better suited for some types of individuals more than others. Here are some scenarios when we think it’s a good fit.

People who do their taxes in one sitting: The H&R Block software is very step-by-step, so much so that it can be difficult to move forward unless you’ve completed everything else in the preceding sections. That makes it perfect for people who like to stick to their to-do list and not move forward until all the right boxes are checked off.

Those who want an in-person option: H&R Block has top-notch software, but it also has a fleet of 60,000 tax professionals to do the work for you. If you decide that your taxes are taking up too much time, you can connect with a dedicated tax expert either virtually with its Online Assist add-on, or in person at some 10,000 locations.

Mobile-savvy tax filers: On the other hand, H&R Block also works well for tech-savvy filers. You don’t even need a computer to do your taxes. You can literally snap photos, upload, and connect to your financial institutions all through the mobile app on your phone.

Business owners: Most online tax software programs offer a self-employed option. But H&R Block can also handle your business tax returns in addition to your personal return. The Premium & Business digital download is quite cost-effective considering a CPA or professional tax preparer would typically charge you for each return separately.

This review is an evaluation of the consumer experience using an online tax prep service. We’re here to share what we learned, but this is in no way a substitute for financial advice. Please consult a financial professional if you have questions about how to file your taxes.

Meet the tester

Lauren Ward

Contributor

Lauren is a personal finance writer covering topics like taxes, investing, and real estate. Her work has appeared on Bankrate, Money Under 30, This Old House, and more. She lives with her family in Virginia and loves gardening and playing board games.

Checking our work.

Our team is here to help you buy the best stuff and love what you own. Our writers, editors, and experts obsess over the products we cover to make sure you're confident and satisfied. Have a different opinion about something we recommend? Email us and we'll compare notes.

Shoot us an email